OUR MISSION IS TO BUILD A TRUSTED PLATFORM FOR INVESTORS SEEKING THE SUPPORT OF A DEDICATED PARTNER TO LEAD AND COMPLEMENT THEIR EFFORTS IN REACHING INVESTMENT OBJECTIVES.

NITAQ CAPITAL

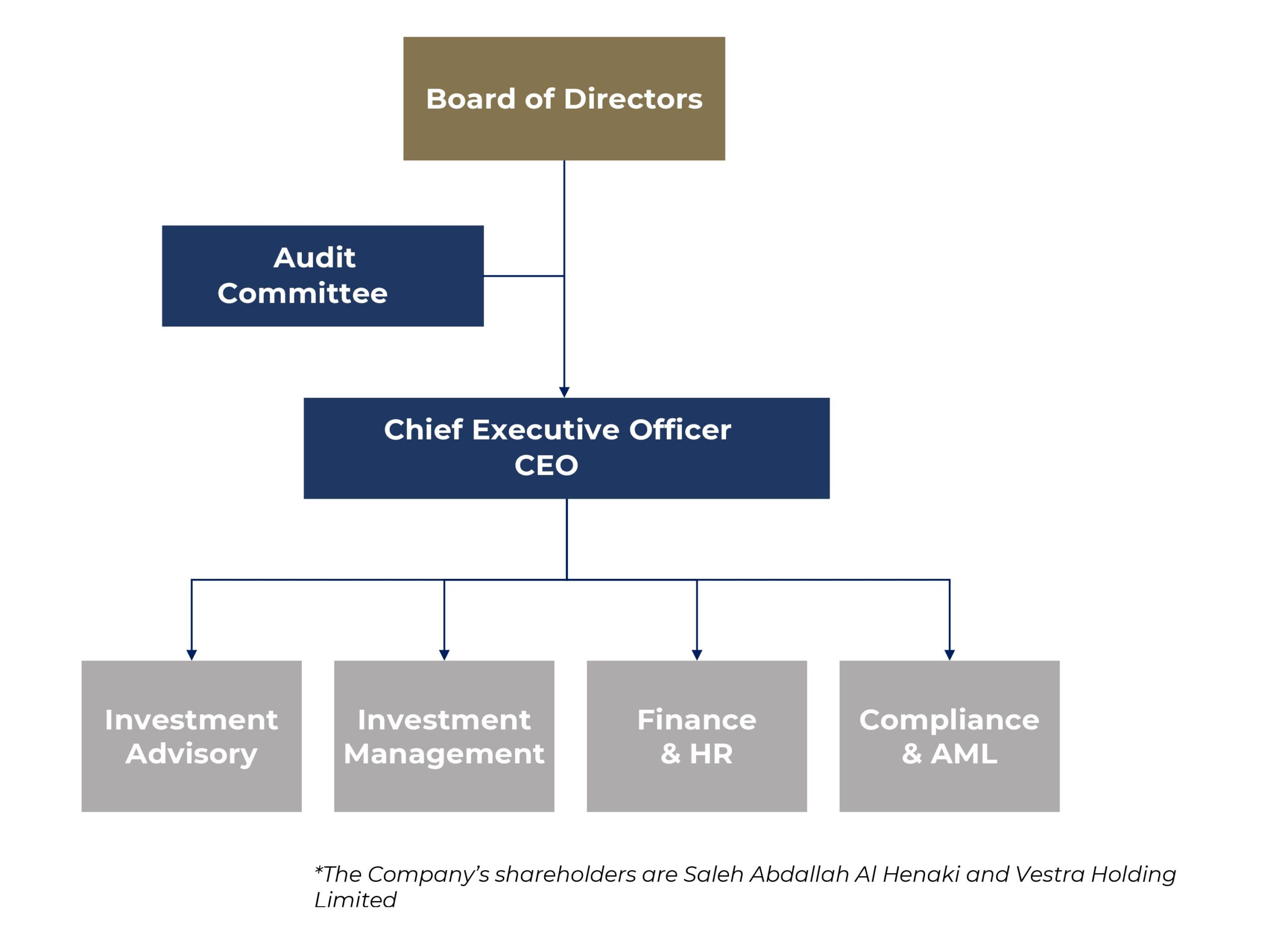

We are based in Riyadh and regulated by the Saudi Capital Market Authority under license number 21225-22 dated 21/6/2021 (commencement date 23/11/2021), CR number 7025664199 dated 8/9/2021 and paid-in capital of SAR 1 million.

We specialize in managing alternative investment funds primarily focused on Private Equity and advisory services for real estate portfolios and transactions.

OUR APPROACH

Our approach is client-centric, which connotes that we prioritize the needs of our clients and create solutions that best caters to them.

OUR SERVICES

Nitaq Capital leverages decades of cumulative experience of its management team and its Board of Directors in providing the highest standards of advisory services to institutional investors and family holdings and managing assets across various asset classes and sectors.

ASSET MANAGEMENT

Access and execution of private equity investments have always been challenging in the local markets and globally. Nitaq has built its core capabilities around executing and managing such investments through two distinct but similar local offerings of Private Equity and Special Situation Funds in addition to global institutional access to top performing managers.

KNOW MORE

ADVISORY SERVICES

With most of local investment houses in the kingdom are in the process of transitioning into institutional setups, Nitaq Capital is geared towards supporting such transition mainly through its investment and real estate advisory services.

KNOW MORE

OUR ETHOS

Focused on delivering premium services to its clients, Nitaq Capital exhibits key capabilities and advantages. Some of these are highlighted below:

Committing

to understanding the needs of our clients

Employing

the best investment professionals

Innovating

product and service offering

Customizing

services to the local context

Aligning

with clients’ long-term interest

Partnering

with specialists to deliver a holistic solution

Respecting

sharia principles and guidelines

Excelling

with the highest ethical standards

Dealing

fairly and transparently with all clients

THE TEAM

A multi-disciplinary team composed of tenured investment professionals, governed by renowned board of directors.